*BLUF

Massachusetts killed Kalshi’s core defense that it’s a “regulated exchange” vs sportsbook—despite the platform being flooded with sports wagers.

Massive W for M.A.’s A.G. Andrea Joy Campbell, blocking Kalshi from offering sports-related contracts to states’ residents without full state gaming licensure.

Massive L for the masses *sigh* mainlining this degenerate type sh*t.

Good morning,

Kalshi: fundamentally evil or functionally flawed? Embrace the power of "and."

Students learn the financial system, then tell me “no one believes in it” anymore.

2002 Sarbanes-Oxley (signaling to the best companies: skip the IPO, stay private) shows its impact. See the system’s upsides going straight to billionaires, big PE, big VC.

For everyone else? Bootstraps. Scraps. Craps.

Students ask me: “If the game is rigged, why should we play by those rules? Why should we get stuck with the bag?”

Shaking my head,

Austin Campbell

Teaching DeFi at NYU Stern

Tweaking TradFi at Zero Knowledge

ZERO IN

BACK UP

📊TRADE ON ANYTHING

Kalshi. They’re a "regulated exchange" of “prediction markets” and a platform to post predictions that people can put their money behind.

Sports. Elections. Weather. Whether a human will land on Mars before California starts high-speed rail (currently [22]% odds—if yes, a [78]% return).

BELOW THE HOOD

🏀SPORTSBOOK STEW

Kalshi cooks like its a compliance hack *opens order book*

Sports predictions are 90% of activity, 89% of revenue.

Non-sports? Garnish.

“Not us, becoming an actual sportsbook!!”

BAD NEWS

FUN REGS = NOT FUN

Ask anyone at Fanduel, Draftkings, or those Trump casinos.

21+ Age Verification

Ad disclaimers

Strict Deposit Limits

18+ Minimum

No Ad Disclaimers

Self-Serve Limits

Basically, Kalshi: “we’re not fun-tech…we’re fintech that happens to be fun 😉”

BAD HOMBRES

🚨CAUGHT IN 4K

REALITY CHECK?

GIANNIS ANTETOKOUNMPO

When an NBA superstar's contract decisions generate $23M in gambling volume on your "prediction market"—then he becomes a stakeholder? Convenient.

BEHIND THE SCENES

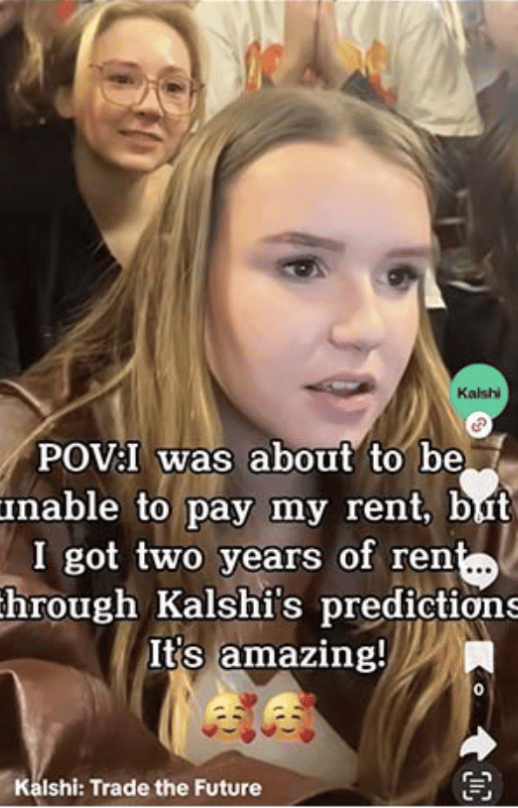

📺 SNIPERS ON SOCIAL

Kalshi's user growth playbook: financial nihilism, feminine empowerment, masculine "everyone wins" messaging, blitzing across TikTok, Instagram, X.

In securities markets, this type of advertising = illegal (when was the last time Fidelity told you punting on TSLA paid two years of rent?)

BEHIND THE MESSAGING

“WIN ON WHAT YOU KNOW”

At least, the idea sounds straight: "Markets are rigged for finance bros who know the fancy stuff. At least our markets are rigged for you, for what you know."

"Masspirational" messaging strategy: mission, meaning, relatable casting for mass adoption of insider products that have been remixed for outsiders.

Millennials bought in. Gen Z buys in…at a bigger price: no aspiration without actualization and a dash of acceleration.

Gen Z won’t wait for "someday" vs "today."

Kalshi sells today.

BAG HOLDERS

🧛🏻♂️ NOT PEOPLE, PREY

Let's look at the "honesty" in what they’re not saying,

Markets without meaningful regulations favor the house, whales, scammers. Median participant? Fleeced. Massive rugs, by design.

Player Set 1

People starting out their lives with young kids—too normie to be Wall St weather pattern quants, tech-native psychos, etc.

Player Set 2

Psychopathic bots scanning underpriced odds, pulling forecasts via API → Transforming its $197 into $7,342 (straight from the pool of Player Set 1 : civilians like my students, staff, etc.)

BASICALLY

🩸 PEOPLE LOSE ALL

Structurally, this business model sustains on “toxic flow”

i.e., "dumb money" offsetting "smart money".

Sustenance requires an infinite farm of:

Delusionals (false hopers)

Irrationals (fake math-ers)

Desperates (f*cked up)

So not user growth, but user growth.

Sackler-style.

BANNERS RISING

✊ STATES STAND UP

2024: Legitimacy Halo

Kalshi wins court battle on election contracts. CFTC stamps Designated Contract Market status — branding themselves a "regulated exchange."

Early 2025: Leeroy Jenkins

Scope creeps. Self-certifies "sports contracts". Sports betting explodes (70%+ volume, 89% revenue).

Late 2025: Legal Resistance

Nevada ships cease & desist. Chain reaction—9 states, 34 AGs organize. MA sues: gambling without state licensing, weak safeguards.

Jan 2026: MA Drops Mic 🎤

MA’s A.G. Campbell lands a win. Judge kills the federal pre-emption claim, grants injunction, making it a strong template for the rest.

2026+: Road Ahead, Roulette

Circuit courts split. Class actions on addiction. Biggest bet unresolved. Is a "predictions market" an innovative type of exchange or an irresponsible casino (with infinite money and marketing)?

Final Destination? SCOTUS

Put that in a prediction market.

ZERO OUT

Fintech has its wolves.

Federal preemption isn't an invisibility cloak.

"Regulated exchange" ≠ a “risk-free” card.

Finally, if 90% of your order book is sports?

Sportsbook.

Regulation can exist for a reason. Regulations avoided by misrepresentation, in order to pilfer people’s pockets? Evil.

ZERO ON

ZERO INSIDER

Spoke to CryptoNews' Matt Zahab—dropped a couple days ago.

Still flogging "Stealing The Future: Sam Bankman-Fried, Elite Fraud, and the Cult of Techno-Utopia." See my recent appearance at Codex Books in Manhattan, with Adam Lowenstein of the American Prospect. Snag one: Repeater, McNally Jackson, Random House, Amazon.

1 Missed out? 2026 Crypto Grows Up, Chokepoint 2.0, Bera Bares All